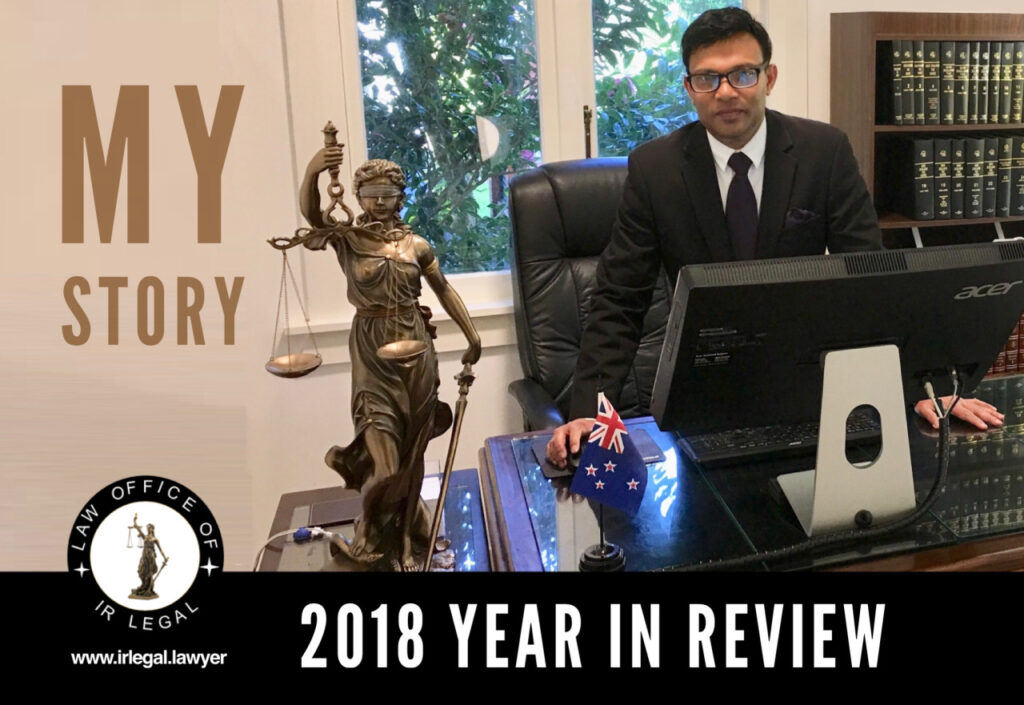

2018 – Year In Review

2018 – Year In Review Kia ora koutou, With another incredibly busy and productive year coming to a close, I would like to take a moment to thank all of my clients and support staff from my two serviced offices in Wellington and Auckland who have contributed immensely to my business during the year! I’ve […]

High Company Income Tax

High Company Income Tax A high company income tax rate is harmful for economic growth Recently, the Government’s Tax Working Group (TWG) released its initial recommendations on how the tax system could be changed. The Government specifically asked the Group to consider the merits of a progressive company tax with lower rates for small businesses. […]

Taxation of Cryptocurrency Transactions

Taxation of Cryptocurrency Transactions Bitcoin and other cryptocurrencies have seen considerable growth over the last 12 months. If you own and use any crypto personally or in business, you’ve probably started investigating your potential tax obligations. In simplest terms, cryptocurrency is money that only exists digitally or virtually. Cryptocurrency uses cryptography and blockchain technology to […]

Immigration Policy Changes – 8 August 2018

Immigration Policy Changes – 8 August 2018 Following a public consultation, Government has come up with changes to immigration settings that impact post-study work rights for international students. The changes are: to remove the employer-assisted post-study work visas at all levels; to provide a one-year post-study open work visa for students studying Level 4 – […]

Cross Boarder Tax Issues

Cross Boarder Tax Issues Tax treatment of withdrawals from foreign superannuation schemes People living and working overseas may contribute to a foreign superannuation (“super”) scheme. For example, New Zealanders who live and work overseas may be required to contribute to a work-related scheme. Non-residents migrating to New Zealand may also have foreign super scheme interests […]

On International Tax

On International Tax International tax is technical in nature and in high political focus. International tax is technical in nature and in high political focus. Governments are taking decisive action to tackle tax evasion and avoidance and ensure all taxpayers pay their fair share. Central to this effort is ensuring that countries implement the internationally […]

The Vital Role of Immigration in Sustaining New Zealand’s Economy Amid an Aging Population

The Vital Role of Immigration in Sustaining New Zealand’s Economy Amid an Aging Population New Zealand, renowned for its breathtaking landscapes and high quality of life, faces a demographic challenge that could have profound implications for its economic sustainability: an aging population. As the proportion of elderly citizens rises, the workforce shrinks, leading to a […]

New Zealand’s Interim Visa vs Australia’s Bridging Visas

New Zealand’s Interim Visa vs Australia’s Bridging Visas Navigating immigration systems can be a complex and stressful experience, especially when awaiting a decision on a substantive visa application. Two visas designed to bridge this waiting period are New Zealand’s Interim Visa and Australia’s Bridging Visa. While both serve a similar purpose, the differences in their […]

Understanding 501 Deportation

Understanding 501 Deportation And How Ir Legal Can Help Deportation under Section 501 of the Migration Act is one of the most severe actions that can be taken against a non-citizen in Australia. This process involves the cancellation of a visa on character grounds, which can have devastating consequences for individuals and their families. In […]

Understanding Australian Capital Gains Tax For Immigrants

Understanding Australian Capital Gains Tax For Immigrants Moving to a new country involves a myriad of challenges, from adapting to a different culture to navigating new financial systems. One critical aspect that immigrants to Australia need to understand is the Capital Gains Tax (CGT). This tax, applicable on the profits made from the sale of […]